There might be affiliate links in this post. If you click on a link and make a purchase, I receive a small commission. Read my disclosure policy here.

Are you cutting corners and spending less on a regular basis,

but not putting away as much money as you would like?

You might be wondering why, but don’t get too flustered…

It doesn’t have to be that way.

Here are tips to get more out of your bank and goal set.

Don’t miss out on how to truly set a goal you can monitor and hopefully reap the savings that you deserve.

How to Turn Your Capital One Account into a Savings Hand Holder

Your savings account is where real savings goes. It’s not to be confused with savings you reaped from smart spending.

So if you used a coupon or bought something at a discounted price, you spent less than the retail price. That has it’s benefits. However, it’s not the type of savings that literally puts money into your bank account. I’ll show you a tutorial to do that.

I confess. I can nerd out on the semantics. However, many people get excited about purchasing items at a deep discount.

They might get more for their money, but real savings comes from saving, not spending! According to BankRate.com, most people don’t have enough money in an emergency fund.

If that’s you, use the tutorial below for that reason or any other financial goal. Once you reach the amount you need to save up, then you can focus on short-term savings goals that you want to carry out like a home improvement project or unique bucket list idea. Here are some tips to get started.

How to Set a Savings Goal with Capital One

1. Go to CapitalOne.com. Click on “sign in” if you already have an account. Otherwise, sign up for one here.

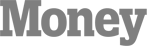

2. For those of you that have an account, sign in and click the account where you want to withdraw money from regularly like a checking account (though they don’t call it that because they don’t issue checks). There will be a “View Account” button.

When you find the account, click on that. If you don’t already have one, create a savings account for your goal. Maybe you entitle it “Emergency Fund”, Summer Bucket List, Dream List Goal or XYZ Goal. It’s your account so it’s up to you.

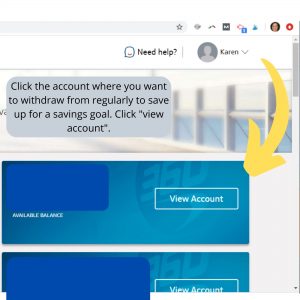

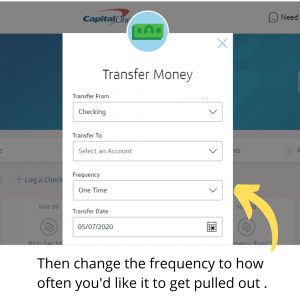

3. The screen will look like this. If you already have a savings account set up, click “Transfer Money”.

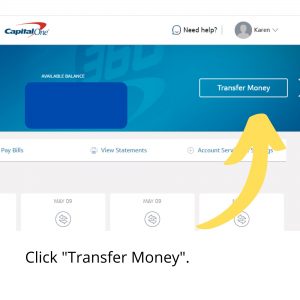

4. Then choose the account where you want to put the money. The drop down menu will allow you to choose from the accounts you have already set up.

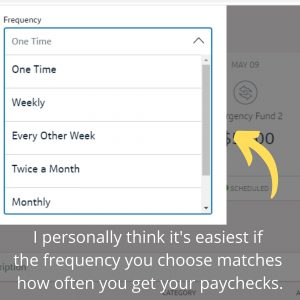

5. Then change the frequency to how often you’d like the money to get pulled out. I personally like it to go with the flow of how often I get paid. It can get pulled out on or around the same day when the money arrives.

6. If you get paid weekly, consider having the money pulled out weekly. If you get paid every other week, then think about pulling it out every other week.

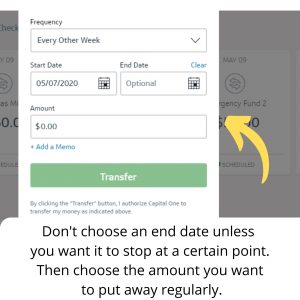

6. If your goal is ongoing or it will possibly take years to achieve, don’t select an end date. If you know you only want to save for an upcoming short term goal that’s six months away, then you can set an end date.

For example, if you get paid weekly and want to save up $5000 in 6 months. Take out $192.30 each week for the next 26 weeks. If you get paid bi-weekly, you’d have to pull out more money ($384.61).

Try to determine a realistic amount beforehand that’s right for your budget. You might have to play with it a bit.

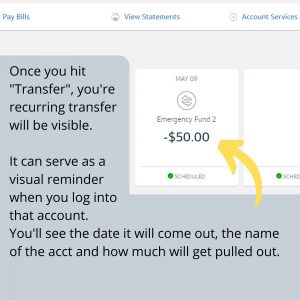

6. Then hit the green transfer button (see above). It will then show when the money will come out. (This is one I set up awhile ago, but it’s there every month.) It helps me remember to keep enough money in the account.

Things to Keep in Mind When Setting a Savings Goal

Just make sure that you are aware that the money will be pulled out on a regular basis so you leave enough in. Sometimes unexpected expenses arise and it could throw things off a bit.

If you create an emergency fund, you’re other financial goals are less likely to fall apart. If you get a flat tire before a vacation, you can readily pull from the emergency fund to pay for it. Otherwise, it can throw off your current budget, bills or take money away from your vacation.

Setting up a recurring transfer can put the exact amount that you need to put away in order to save regularly or meet your goal finish line. If you haven’t already, set up an account with Capital One today.

Saving doesn’t only have to be for emergencies. If you want to work on a fun savings goal at the same time, consider following my challenge and learn how to make a bucket list to get motivated.

Map Everything Out with a Savings Goals Tracker Printable

Also, if you’d like to map out the savings goal numbers first to more clearly understand how to get from point A to point B, the saving goal tracker has you covered! It helps you see how much you need to contribute regularly so you can track your progress and stay motivated along the way.

Here’s the deal, sometimes you need to plot the steps out to visually see where you’re going. It makes it concrete and tangible. Using savings goal worksheets can majorly squashed overwhelm too!

Click here or on the image to get the savings goal tracker template!

Do you have another way to set a savings goal? While it’s fresh on your mind, write about it in the comments now. Also, remember to share this post.

Conclusion for Setting a Savings Goal

Setting a savings goal doesn’t have to be hard. Use a bank like Capital One to have the money automatically set aside for you. It’s one less thing you have to do and you can save money effortlessly.

Related Budget-related Articles